If your fence has recently been damaged by a storm, you’re probably wondering whether filing an insurance claim is the right move. While it might seem like an easy decision, the reality is more complex. There are several factors to consider, including the extent of the damage, your insurance policy, and the potential long-term impacts of filing a claim. In this blog post, we’ll break down the pros and cons of filing an insurance claim on your storm-damaged fence, helping you make an informed decision.

The Pros of Filing an Insurance Claim

1. Financial Relief

The most obvious advantage of filing an insurance claim is financial assistance. Fence repairs can be expensive, especially if a large portion is damaged or needs to be replaced entirely. Filing a claim can help cover repair costs, leaving you with little to no out-of-pocket expenses. Depending on your coverage, you could save hundreds or even thousands of dollars.

2. Prevents Further Damage

If your fence is seriously damaged, it may no longer protect your property adequately. Without a functioning fence, your yard could be exposed to intruders, wildlife, or even further storm damage. Filing a claim allows you to get the fence repaired quickly, minimizing the risk of more significant issues.

3. Peace of Mind

Knowing that your insurance company will cover the cost of repairs can provide peace of mind. You won’t have to worry about finding the money to fix the fence or cut corners with subpar materials or labor. A properly handled insurance claim can ensure that your fence is restored to its original condition—or even improved.

4. Protects Property Value

A broken or damaged fence can decrease your home’s curb appeal and, subsequently, its value. Filing a claim and getting your fence repaired quickly can help maintain the overall value of your property. This can be especially important if you are planning to sell your home in the near future.

Click here to talk to specialist!

The Cons of Filing an Insurance Claim

1. Deductibles Can Be Costly

One of the first things to check is your insurance policy’s deductible. In many cases, the cost of fence repairs may not exceed your deductible, meaning you’ll end up paying for the repairs out of pocket anyway. If the deductible is too high, filing a claim may not be worth it, and you could be better off handling the repairs yourself.

2. Risk of Increased Premiums

Filing any insurance claim comes with the risk of increased premiums. Even if the claim is for a storm-damaged fence—something beyond your control—insurance companies may view you as a higher-risk customer. This could lead to higher premiums in the future, meaning you might pay more in the long run than you save by filing the claim.

3. Possibility of Claim Denial

Not all insurance policies cover fences, and even if they do, the cause of the damage might not be covered. If your policy has strict guidelines about what constitutes “storm damage,” there’s a chance your claim could be denied. For instance, if the damage is due to pre-existing wear and tear or poor maintenance, your insurance company might refuse to pay.

4. Potential Impact on Future Claims

Filing multiple claims within a short period can flag you as a high-risk policyholder, leading your insurer to either raise your premiums significantly or even deny future coverage. For something like a fence, which may be less costly than major home repairs, it’s worth considering whether the claim is necessary or if you’d prefer to save that option for a larger, more expensive issue down the road.

5. Time-Consuming Process

Filing an insurance claim is rarely a quick process. You’ll need to gather documentation, submit it, wait for an adjuster to assess the damage, and then wait again for approval. In some cases, this could take weeks or even months, leaving your fence in a state of disrepair while the process plays out. If you need to fix your fence immediately, you might not want to deal with the delays of the claims process.

Click here to talk to specialist!

When Should You File a Claim?

Whether you should file an insurance claim for your storm-damaged fence largely depends on the cost of repairs versus your deductible and the overall impact on your property. Here are a few key situations where filing a claim makes sense:

- Significant Damage: If the storm caused extensive damage, and repair costs far exceed your deductible, filing a claim is likely the best option.

- Fence is Essential: If your fence serves an important function—like keeping pets in, providing security, or maintaining privacy—filing a claim ensures that you can get it fixed quickly.

- Long-Term Impact on Property Value: If leaving the damage unrepaired could hurt the value of your home, a claim can be a wise investment in maintaining your property’s worth.

Click here to talk to specialist!

When Might You Skip Filing a Claim?

On the flip side, there are situations where you might want to avoid filing a claim, including:

- Minor Damage: If the damage is minimal, and the cost of repairs is close to your deductible, you’re better off paying for the repairs out of pocket to avoid potential premium hikes.

- High Deductible: If your deductible is high, filing a claim might not make financial sense, especially if you can afford to pay for the repairs yourself.

- Fear of Increased Premiums: If you’ve recently filed other claims or are worried about the long-term impact on your insurance rates, it may be wiser to handle the repairs without involving your insurance.

Click here to talk to specialist!

Conclusion

Filing an insurance claim for your storm-damaged fence can be a financial lifesaver in some cases, but it’s not always the best course of action. Carefully weigh the pros and cons, considering your deductible, the potential for increased premiums, and the cost of repairs before making a decision. If you’re ever in doubt, a quick call to your insurance agent can help clarify your options and ensure you make the best choice for your specific situation.

No one enjoys dealing with a damaged fence, but with a smart approach, you can minimize the headache and keep your home looking great.

Good Recommendations for Insurance Providers

Isaac Anderson | Marketing Representative

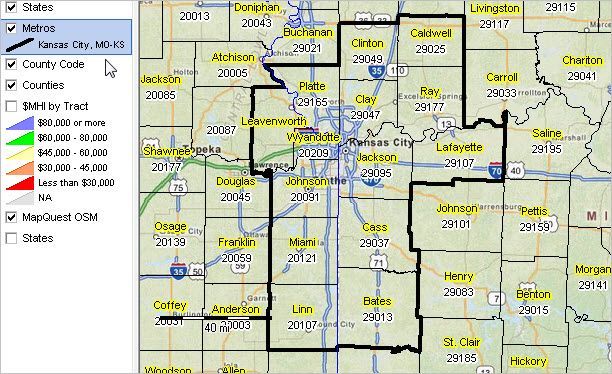

Federated Insurance – Jackson, Cass & Bates County

PO Box 480543

Kansas City, MO 64148

C: (208) 559-7281 | E: idanderson@fedins.com

Patrick Slingsby ~ Slingsby Insurance Agency

1121 Crawford Street

Clay Center, KS 67432

785-632-2486 ~ https://www.slingsbyinsuranceagency.com/